dashlk.site

Tools

Can I Take 1000 Mg Of Ibuprofen At Once

Mixing ibuprofen with herbal remedies and supplements. It's best not to take gingko biloba with ibuprofen as it can increase the chance of bleeding. There's. Ibuprofen (eye-byoo-PRO-fen) is a medicine you can buy without a prescription to relieve fever and pain. It's a safe drug for many problems when used correctly. The recommended dose of ibuprofen is mg by mouth every hours as needed for pain or fever. Adults should not exceed a maximum daily dose of mg. Taking aspirin and other painkillers. It's safe to take aspirin as a painkiller with paracetamol or codeine. But do not take aspirin with ibuprofen or naproxen. Taking too much ibuprofen can result in an overdose. This can cause dangerous side effects such as damage to your stomach or intestines. How will I take prescription strength pain medication Around-The-Clock? You will take acetaminophen every six hours. ○ Take milligram (mg) of. The recommended adult dosage is one or two milligram (mg) Advil tablets every 4 to 6 hours, not exceeding mg at once or 3, mg daily. Pro tip: To. The maximum safe dosage of acetaminophen for anyone over the age of 12 is 4, milligrams (mg) per day. But even this amount can harm some people's livers, so. A single dose is usually two mg pills taken every six hours. The maximum amount of acetaminophen is no more than 1, mg at one time or 3, mg within Mixing ibuprofen with herbal remedies and supplements. It's best not to take gingko biloba with ibuprofen as it can increase the chance of bleeding. There's. Ibuprofen (eye-byoo-PRO-fen) is a medicine you can buy without a prescription to relieve fever and pain. It's a safe drug for many problems when used correctly. The recommended dose of ibuprofen is mg by mouth every hours as needed for pain or fever. Adults should not exceed a maximum daily dose of mg. Taking aspirin and other painkillers. It's safe to take aspirin as a painkiller with paracetamol or codeine. But do not take aspirin with ibuprofen or naproxen. Taking too much ibuprofen can result in an overdose. This can cause dangerous side effects such as damage to your stomach or intestines. How will I take prescription strength pain medication Around-The-Clock? You will take acetaminophen every six hours. ○ Take milligram (mg) of. The recommended adult dosage is one or two milligram (mg) Advil tablets every 4 to 6 hours, not exceeding mg at once or 3, mg daily. Pro tip: To. The maximum safe dosage of acetaminophen for anyone over the age of 12 is 4, milligrams (mg) per day. But even this amount can harm some people's livers, so. A single dose is usually two mg pills taken every six hours. The maximum amount of acetaminophen is no more than 1, mg at one time or 3, mg within

If additional pain relief is needed, take mg of Tylenol with the Ibuprofen every hours as needed. DO NOT exceed mg of Tylenol per day. For example, if you take ibuprofen at 6 am you can then take Tylenol at 9 am. you should not take more than mg in 24 hours unless otherwise instructed by. The recommended dose of ibuprofen is mg by mouth every hours as needed for pain or fever. Adults should not exceed a maximum daily dose of mg. When you are taking it OTC do not exceed mg. You can take mg 3 times a day. Ibuprofen can cause damage to stomach muscles leading to. Taking too much ibuprofen can result in an overdose. This can cause dangerous side effects such as damage to your stomach or intestines. The recommended adult dosage is one or two milligram (mg) Advil tablets every 4 to 6 hours, not exceeding mg at once or 3, mg daily. Pro tip: To. mg once to twice daily, mg. Relative COX-2 selectivity and minimal Base: mg (acute); mg (chronic); may increase to mg during a. If you or someone you are with overdoses, call the local emergency number (such as ), or the local poison control center can be reached directly by calling. The symptoms of overdose are presented in individuals that consumed more than 99 mg/kg. Most common symptoms of overdose are abdominal pain, nausea, vomiting. Mild to moderate pain. mg paracetamol four times daily. Or mg ibuprofen three times daily ; Moderate to severe pain. –mg ibuprofen three to four. Doesn't matter as a one time event. We regularly give people mg ibuprofen. Taking mg once is not much different. Upvote Downvote. However, the dose is usually not more than 4 tablets per day, and should not be taken for longer than 7 days, unless directed by your doctor. Your doctor may. The recommended initial dosage of Ibuprofen is mg per day in divided doses. Some patients can be maintained on mg per day. In severe of. You can't really OD on Ibuprofen. The LD50 is like mg/kg so if you weight 70 kilograms (lbs) you would need to take around 53,mg. Although relatively safe in humans, ibuprofen and other NSAIDs can be extremely harmful to dogs. Once vomiting is controlled, activated charcoal may be. And mg paracetamol four times daily. *For severe or acute conditions ibuprofen can be prescribed to a maximum of g daily (mg four times a day). You can take up to two every 4 hours as needed for pain. There are varying strengths so if not working for you or if it is too strong please call Dr. Mall. This. For mg, adults and children 12 years and over: Take 1 tablet every 4 - 6 hours as needed; Do not take more than 3 tablets in 24 hours, unless directed by a. Do not take more non-prescription ibuprofen and acetaminophen than the Take pills of ibuprofen mg. (total dose = mg) and pills of acetaminophen mg. In general, for adults with normal liver function, you can take up to 3 g/day ( mg every 8 hours) without any risk to your liver. For those with heavy.

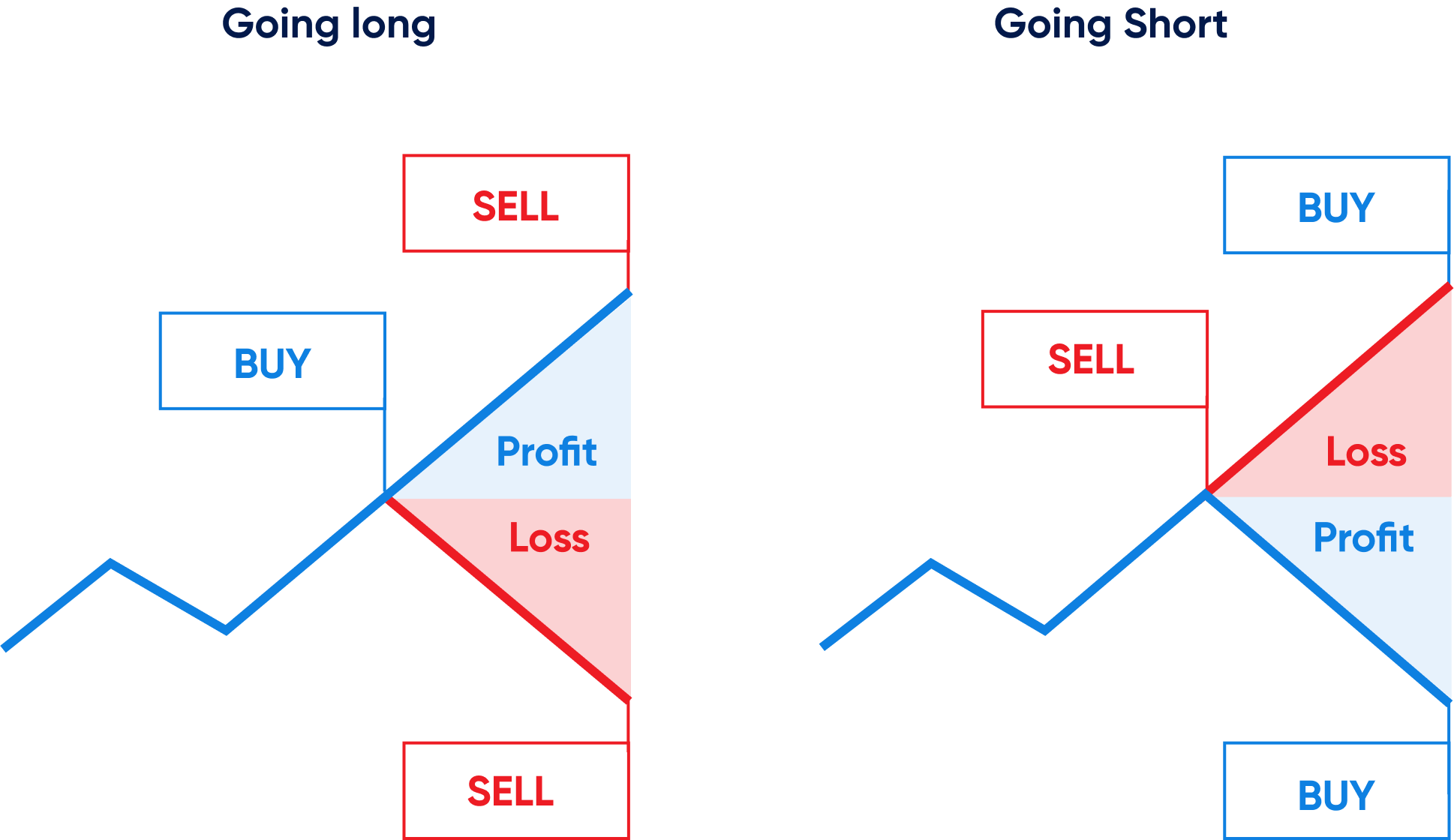

Assets I Can Buy

Savings/checking/money market accounts: These asset accounts allow the owner to have money stored in a safe place, such as a bank. Some of these accounts can be. If you think it will be sold at a profit in one year or less, it's liquid. How personal guarantees could put your assets at risk. In order to open a business. Investing in passive income generating assets like REITs or rental properties will help you for your retirement. You can buy and sell them. How Much House Can You Afford? Mortgage Basics · Beyond Mortgage Costs. Jobs List your assets (what you own), estimate the value of each, and add up. Buying assets can be a smart investment choice as its value grows over time. On the other hand, investing in liabilities may meet certain ends for the time. A multi-asset strategy combines different types of assets – stocks purchase or sale would be unlawful under the securities laws of such jurisdiction. Generally, land and real estate are considered among the least liquid assets, because it can take a long time to buy or sell a property at market price. We'll help you navigate the types of digital assets you might be exposed to, and how and where to buy and sell them. For example, you could purchase a single-family home to begin renting out. You could then use the income generated from this property to purchase another rental. Savings/checking/money market accounts: These asset accounts allow the owner to have money stored in a safe place, such as a bank. Some of these accounts can be. If you think it will be sold at a profit in one year or less, it's liquid. How personal guarantees could put your assets at risk. In order to open a business. Investing in passive income generating assets like REITs or rental properties will help you for your retirement. You can buy and sell them. How Much House Can You Afford? Mortgage Basics · Beyond Mortgage Costs. Jobs List your assets (what you own), estimate the value of each, and add up. Buying assets can be a smart investment choice as its value grows over time. On the other hand, investing in liabilities may meet certain ends for the time. A multi-asset strategy combines different types of assets – stocks purchase or sale would be unlawful under the securities laws of such jurisdiction. Generally, land and real estate are considered among the least liquid assets, because it can take a long time to buy or sell a property at market price. We'll help you navigate the types of digital assets you might be exposed to, and how and where to buy and sell them. For example, you could purchase a single-family home to begin renting out. You could then use the income generated from this property to purchase another rental.

You can amortize goodwill for 15 years. When you agree to purchase the assets of a company, you are not buying the business entity. Here's an example: You want. These asset types include real estate, equipment, and equity ownership in a business. The first debt category, real estate debt, is the easiest to search. For a. Setting clear investment goals can help you determine if you're investing the right amount, at the right time, and in the right mix of assets. It can help you. We offer a variety of assets that you can invest in, from stocks to options. Chinese securities affected by the White House's executive order from Nov. “Asset” is a general term that includes stocks, bonds, real estate, and other purchases that have (theoretically) appreciating value. As a note, it is possible. How Much House Can You Afford? Mortgage Basics · Beyond Mortgage Costs. Jobs List your assets (what you own), estimate the value of each, and add up. Best Income Generating Assets / Assets to Buy. Assets That Generate Income · Real Estate · Stocks · Savings Accounts · Certificates Of. In an asset purchase, the buyer will only buy certain assets of the seller's company. The seller will continue to own the assets that were not included in the. Payments to asset forfeiture payees could be delayed for several reasons. Buy? Ten Steps to Doing Business with the USMS · WHAT WE DO · Judicial Security. Have you ever wanted to invest in rental real estate without managing the property (and tenants) yourself? Well, now you can! An income generating asset such as. I would not consider real estate a "starter" asset for an investor. It takes a large initial investment, rental real estate can require a large investment of. Intangible assets such as good will, stocks and bonds, etc. Successor liability: Buyer beware. As the buyer of a business, you could be liable for the unpaid. Asset allocation involves dividing your investments among different assets You can buy new investments for underweighted asset categories. If you are. Rather than leaving your heirs cash, you could buy these valuable assets yourself towards the end of your life and then leave them as an inheritance. Since. Unlike margin, these nonpurpose credit lines may not be used to purchase securities or pay down margin loans, nor can the funds be deposited into any brokerage. Some real estate is a great investment, some isn't. Sometimes the market is good, sometimes bad, and owning property can come with a lot of. You also can't use line of credit funds to buy investment securities, or repay another margin loan. In addition, there is market risk; should the assets in the. But you can buy a group of them in a stock fund and reduce your risk. You won't enjoy the ease of buying and selling your assets in the stock market. There can be no assurance that the Funds will achieve their investment objectives. Asset Management to buy, sell, or hold any security. Views and opinions are.

Youtube Money Made

Daily video views ; $ estimated daily earnings ; $ estimated monthly earnings ; $10, projected yearly earnings. Creators in the YouTube Partner Program can earn ad revenue from their long and short-form videos through ads, ad revenue sharing, and YouTube Premium. Ways to make money in the YouTube Partner Program · Channel memberships: Your members make recurring monthly payments in exchange for access to special perks. How to Make Money on YouTube · You must first have a Google account. · You must also have a YouTube channel. · To make money, you must have at least one video. ⭐ How much does YouTube pay you for 1 million views? YouTube pays you approximately $3 – $5 USD for every views. So for 1 million views on YouTube, you. How do you earn money on YouTube? You can earn money on YouTube through advertising by joining the YouTube Partnership Program, selling affiliate products. Use our free YouTube money calculators to estimate the ad revenue from monetized YouTube videos. You can estimate the possible earnings by daily video views. Fan Funding. Another popular way to monetize a channel is through channel memberships. Fans and followers make recurring monthly payments in exchange for bonus. YouTube Creators who are a part of the YouTube Partner Program, can earn money on the platform. Learn more about YouTube creator monetization sources. Daily video views ; $ estimated daily earnings ; $ estimated monthly earnings ; $10, projected yearly earnings. Creators in the YouTube Partner Program can earn ad revenue from their long and short-form videos through ads, ad revenue sharing, and YouTube Premium. Ways to make money in the YouTube Partner Program · Channel memberships: Your members make recurring monthly payments in exchange for access to special perks. How to Make Money on YouTube · You must first have a Google account. · You must also have a YouTube channel. · To make money, you must have at least one video. ⭐ How much does YouTube pay you for 1 million views? YouTube pays you approximately $3 – $5 USD for every views. So for 1 million views on YouTube, you. How do you earn money on YouTube? You can earn money on YouTube through advertising by joining the YouTube Partnership Program, selling affiliate products. Use our free YouTube money calculators to estimate the ad revenue from monetized YouTube videos. You can estimate the possible earnings by daily video views. Fan Funding. Another popular way to monetize a channel is through channel memberships. Fans and followers make recurring monthly payments in exchange for bonus. YouTube Creators who are a part of the YouTube Partner Program, can earn money on the platform. Learn more about YouTube creator monetization sources.

MrBeast · Est. YouTube Partner Earning[Monthly]. $MCPM: $$ · Subscribers. ,, · Est. Potential Earnings[Each Video]. $MCPM: $$ The tool below has been developed to allow you to easily calculate the estimated earnings from a Youtube Video or Channel and is based on your video view. You need 1, subscribers and a minimum of 4, watch hours over the last 12 months or 10 million Shorts views in the last 90 days. Can you get paid on YouTube without a bank account? Depending on your location, you may be able to receive your AdSense payments by check. You will have to cash. 32k subs and I make between $1k-3k a month on my bigger channel. smaller channel is 5k subs and around $ a month. Once you qualify for monetization, YouTube takes a 45% cut from ad revenue. Generally speaking, YouTubers generate around $18 per 1, ad views—or between $3. YouTubers make money through advertisements. It does not matter how many videos your video itself has or how many subscribers you have. You will not receive. The primary way creators make money on YouTube is through ad revenue. This simply means YouTube shares a cut of revenue with eligible creators when viewers. YouTube pays creators for ad views, not simply for video views. The distinction is crucial because the earnings from YouTube come not from the. You need 1, subscribers and a minimum of 4, watch hours over the last 12 months or 10 million Shorts views in the last 90 days. The YouTube Partner Program lets creators monetize their content on YouTube. Creators can share revenue from advertisements on their videos. The YouTube Partner Program is a comprehensive partner program available to Creators, delivering support, monetization opportunities and more. Once you're in. Well, it's a challenging question as the amount paid by YouTube depends upon various factors like the number of views, engagements, etc. As far as ad revenue is. Average earning per 1, views: $ average YouTube ad revenue for 6 months. Days We Spend monthly earnings over the past six months . How much money can you make per 1 million views on YouTube? Based on Hubspot's estimated average CPM of $7 to $10, U.S. YouTubers stand to make $3, to. Our YouTube Money Calculator helps you estimate the daily, monthly, or even yearly earnings on your YouTube videos. To get the calculation, you will need to. How to make money on YouTube · 1. Join the YouTube Partner Program · 2. Sell your own merch · 3. Create sponsored content · 4. Become an affiliate partner · 5. The YouTube Earnings Calculator helps maintain transparency in influencer pricing by taking into account the YouTuber's video view count and ER apart from the. 1 million views = $/month. 3 million views = $1,/month. 6 million views. YouTube pays creators for ad views, not simply for video views. The distinction is crucial because the earnings from YouTube come not from the.

Zenbusiness Llc Reviews

The company has an “Excellent” rating on TrustPilot and a out of five-star user rating based on over 12, reviews. With that said, ZenBusiness has. As you'll soon discover in this Zen Business Review, they also have some of the most affordable pricing among similar LLC formation services. Is your interest. This is a scam business, only out for people's money. They charge a yearly subscription to do absolutely nothing. They. ZenBusiness is the best option for those looking to form their business quickly and efficiently. With its easy-to-navigate website and helpful customer service. ZenBusiness has a great reputation among customers, who have given the company a rating of "Excellent" on Trustpilot, based on over 14, reviews. The company. Northwest Registered Agent Review - The Best Choice for Forming Your LLC · ZenBusiness Review: Pros and Cons of Forming Your LLC with. In June , BBB began investigating ZenBusiness, Inc's business practices. This investigation was prompted by a large volume of complaints and customer. ZenBusiness has a good reputation and stands among the leaders in the business formation industry. It is an affordable, simple, and trustworthy LLC entity. ZenBusiness ties for No. 1 in our rating of the Best LLC Services. Its LLC service is available for as low as $0 plus state filing fees. There are yearly. The company has an “Excellent” rating on TrustPilot and a out of five-star user rating based on over 12, reviews. With that said, ZenBusiness has. As you'll soon discover in this Zen Business Review, they also have some of the most affordable pricing among similar LLC formation services. Is your interest. This is a scam business, only out for people's money. They charge a yearly subscription to do absolutely nothing. They. ZenBusiness is the best option for those looking to form their business quickly and efficiently. With its easy-to-navigate website and helpful customer service. ZenBusiness has a great reputation among customers, who have given the company a rating of "Excellent" on Trustpilot, based on over 14, reviews. The company. Northwest Registered Agent Review - The Best Choice for Forming Your LLC · ZenBusiness Review: Pros and Cons of Forming Your LLC with. In June , BBB began investigating ZenBusiness, Inc's business practices. This investigation was prompted by a large volume of complaints and customer. ZenBusiness has a good reputation and stands among the leaders in the business formation industry. It is an affordable, simple, and trustworthy LLC entity. ZenBusiness ties for No. 1 in our rating of the Best LLC Services. Its LLC service is available for as low as $0 plus state filing fees. There are yearly.

The service boasts a staggering /5 rating on Trustpilot – a rating based on more than 4, real customer reviews. Let's take a look at what some of them. ZenBusiness reviews its own products and services and compares them to others in the industry. MyCompanyWorks LLC review below or form your LLC with. ZenBusiness provides a great service to businesses of every size. Whether you are just thinking about forming an LLC or corporation, need yearly taxes filed or. ZenBusiness and Active Filings are both reliable LLC formation services, and either can form a compliant entity. However, we have a few advantages. ZenBusiness has 5 stars! Check out what people have written so far, and share your own experience. ZenBusiness has a well-designed website that is easy to navigate and order from. Unlike Inc Authority, it does not show you multiple upsells as you try to order. As you'll soon discover in this Zen Business Review, they also have some of the most affordable pricing among similar LLC formation services. Is your interest. 1> Cost: ZenBusiness tends to be more cost-effective for LLC formation services compared to LegalZoom, especially considering their lower. I'm balancing cost-effectiveness with ensuring I'm setting up my LLC correctly. The ZenBusiness Premium package and the local attorney are the two options I'm. ZenBusiness is the best option for those looking to form their business quickly and efficiently. With its easy-to-navigate website and helpful customer service. Overall, ZenBusiness has an outstanding offer for LLC operating agreements, especially if you still need to form your business too. Our great customer feedback. ZenBusiness is a reliable and consistent LLC registered agent service. It offers everything a new business needs to get established, with great customer support. Starts at $0 plus state fees. Form your LLC to make your business official and protect your personal assets. Choose worry-free compliance and rest easy. We'll. ZenBusiness can do more than merely incorporate your business. Going through ZenBusiness LLC reviews, we discovered that entrepreneurs on a tight schedule and. 1 spot on our Best LLC Services of rating. It's the best solution for cash-poor startups and established businesses wanting to form an LLC or corporation. ZenBusiness has achieved an impressive rating of out of 5, reflecting the high level of customer satisfaction with their services. Customers praise the. They hold an average rating of out of 5 on major review portals such as Trustpilot. A large number of positive reviews is all the more impressive. They hold an average rating of out of 5 on major review portals such as Trustpilot. A large number of positive reviews is all the more impressive. ZenBusiness reviews its own products and services and compares them to others in the industry. dashlk.site LLC review below or choose ZenBusiness today. We recommend ZenBusiness. ZenBusiness has an excellent track record, offers fast turnaround times, has great customer service, and sports excellent reviews from.

Personal Loan For Marriage

I know someone who took out a loan for their wedding almost 5 years ago and they are still trying to pay it back. Personally I would cut the. Low-rate fixed loan. Loan amounts up to $20,*; No pre-payment penalty. Zero collateral needed. Online loan application available. For wedding expenses, and many major life events, TD Bank offers unsecured personal loans. They offer several advantages that make them an option for financing. Interest rates on wedding loans can vary depending on the lender, your credit score and the length of the loan. OneMain Financial offers personal loans with. You can cover the big ticket items and unexpected costs a wedding can bring with a personal loan. Read the article. Airplane in the clouds. At Tata Capital, the maximum loan amount for a marriage loan is Rs 35,00, You can avail of this loan for any wedding-related expense ranging from venue and. A wedding loan is a type of personal loan that you'll receive in a lump sum and repay in fixed installments. Wedding loans have fixed annual percentage. A wedding loan could help you avoid credit card debt and relieve stress if you can't afford some or all of your wedding expenses. Still, wedding loans are debt. Annual interest rates on these unsecured personal loans range from %%. A non-sufficient funds (NSF) charge of $45 may be applied to returned payments. I know someone who took out a loan for their wedding almost 5 years ago and they are still trying to pay it back. Personally I would cut the. Low-rate fixed loan. Loan amounts up to $20,*; No pre-payment penalty. Zero collateral needed. Online loan application available. For wedding expenses, and many major life events, TD Bank offers unsecured personal loans. They offer several advantages that make them an option for financing. Interest rates on wedding loans can vary depending on the lender, your credit score and the length of the loan. OneMain Financial offers personal loans with. You can cover the big ticket items and unexpected costs a wedding can bring with a personal loan. Read the article. Airplane in the clouds. At Tata Capital, the maximum loan amount for a marriage loan is Rs 35,00, You can avail of this loan for any wedding-related expense ranging from venue and. A wedding loan is a type of personal loan that you'll receive in a lump sum and repay in fixed installments. Wedding loans have fixed annual percentage. A wedding loan could help you avoid credit card debt and relieve stress if you can't afford some or all of your wedding expenses. Still, wedding loans are debt. Annual interest rates on these unsecured personal loans range from %%. A non-sufficient funds (NSF) charge of $45 may be applied to returned payments.

Wedding loans are often a type of personal loan that many lenders offer. These are installment loans that provide you with a lump sum upfront that you can use. Have the special day of your dreams stress free with low interest personal loans for your wedding from Credit Direct. Apply online, and upon approval. A wedding loan is an unsecured loan that can be approved using financial documents, personal details, and a CIBIL score. You can use a personal loan for almost anything, and there's nothing that says that can't include wedding costs. Personal loans are available through banks. You can use a personal loan for nearly any purpose, including to pay for wedding costs. Personal loans generally have lower interest rates than credit cards. Getting a personal loan for a wedding is a fairly easy process compared to some other types of loans, like mortgages. Rather than checking rates directly with. A personal loan for wedding can cover expenses such as the cost of the venue, the purchase of jewelry for the bride, the cost of guest accommodation. You must be between 21 years and 80 years**. · You must be a salaried employee of an MNC, public, or private company · You must be a resident citizen of India. A wedding loan is a personal loan you can use to help pay for your wedding, honeymoon, and related expenses. You can use any personal loan to pay for a wedding. Banks, credit unions and online lenders offer personal loans you can use to finance wedding-related costs. Whether it's an intimate ceremony or a grand gala, the flexibility of a Personal Loan for Marriage caters to your needs. You can borrow from ₹50, up to. Secure a wedding loan with an attractive interest rate of % and access up to ₹40 lakhs for your dream marriage. Check eligibility, application. Top Lenders Offering Personal Loans for Wedding · Marriage Loan Tata Capital · Marriage Loan HDFC. At Tata Capital, the maximum loan amount for a marriage loan is Rs 35,00, You can avail of this loan for any wedding-related expense ranging from venue and. No, loans for marriage is not necessary. Marriage doesn't have to be a grand celebration. A simple yet traditional marriage could be performed with minimum. If you need help covering large wedding expenses, consider these 4 personal loan lenders ; Best for low rates. LightStream Personal Loans · % - %* APR. Best Personal Loan for Wedding in Bank of Maharashtra: Best in overall marriage loan for employees of government, public and private sectors. Bank of. A wedding loan is simply a personal loan used to pay for wedding-related expenses. Wedding loans are unsecured and require no collateral, and they can be a. Finance your special day—and the honeymoon—with a personal loan from Customers Bank. Our fixed rates ranging from % to % APR¹ will help you manage. You must be between 21 years and 80 years**. · You must be a salaried employee of an MNC, public, or private company · You must be a resident citizen of India.

How Much Taxes Will I Pay As An Independent Contractor

Small-business owners, contractors, freelancers, gig workers, and others who make more than a $ profit must pay self-employment tax. Self-employed workers. Generally, you must withhold and deposit income taxes, social security taxes and Medicare taxes from the wages paid to an employee. Additionally, you must also. You will owe self-employment taxes, which amount to % of your net income, along with federal and state income taxes. Q. How much income is. As an independent contractor, you're required to pay your federal and state (if applicable) taxes to the Internal Revenue Service (IRS) and state revenue. The independent contractor receiving payment may be an individual (who would receive a T4A), a sole proprietorship, a partnership or a corporation. Whether or. You must pay estimated taxes on a quarterly basis. Specifically, you are responsible for paying: Income tax; Self-employment tax (SE tax). As the IRS explains. TaxAct's self-employed tax calculator is your tool for accurately estimating your tax obligations according to the prevailing self-employment tax rates. As an independent contractor, you're responsible for the full % share, listed as "self-employment income" on your tax return. In essence, being a What is the tax rate? workers are taxed at a % self-employment rate. Normally, this % is split equally between employers and employees. Small-business owners, contractors, freelancers, gig workers, and others who make more than a $ profit must pay self-employment tax. Self-employed workers. Generally, you must withhold and deposit income taxes, social security taxes and Medicare taxes from the wages paid to an employee. Additionally, you must also. You will owe self-employment taxes, which amount to % of your net income, along with federal and state income taxes. Q. How much income is. As an independent contractor, you're required to pay your federal and state (if applicable) taxes to the Internal Revenue Service (IRS) and state revenue. The independent contractor receiving payment may be an individual (who would receive a T4A), a sole proprietorship, a partnership or a corporation. Whether or. You must pay estimated taxes on a quarterly basis. Specifically, you are responsible for paying: Income tax; Self-employment tax (SE tax). As the IRS explains. TaxAct's self-employed tax calculator is your tool for accurately estimating your tax obligations according to the prevailing self-employment tax rates. As an independent contractor, you're responsible for the full % share, listed as "self-employment income" on your tax return. In essence, being a What is the tax rate? workers are taxed at a % self-employment rate. Normally, this % is split equally between employers and employees.

Self-Employment Tax: The Basics. Get a better understanding of what self-employment taxes are, how much you'll be taxed, and why you'll need to pay them. You may receive a form from a client during tax season if you're an independent contractor. This means your client is classifying you as a employee. What method (HRIS or FIS) should be used to pay an individual? Overview. The University is required to apply the appropriate tax treatment, under the Income Tax. As an independent contractor, you will have to cover all aspects of income and self-employment (Social Security/Medicare) tax on the NET earnings of your As a self-employed individual, generally you are required to file an annual income tax return and pay estimated taxes quarterly. The total earned income is then subject to the independent contractor tax rate of %. Q. How much should I take out for taxes? It's generally advised. Instead, in the year that you start your business, you can normally keep all the funds you collect until you have to pay your income tax to the Canada Revenue. Your estimated tax payments are due four times per year. You can use Schedule SE to help you calculate how much you owe at each deadline. The deadlines for. Independent contractors working with mortgage brokerage firms are taxable under the Service and Other Activities B&O tax classification on their gross. contractors pay the full % from the money they earn. They also need to file quarterly estimated tax payments and pay quarterly estimated federal and. As a rule of thumb, freelancers should set aside at least % of their total income to cover their bases at tax time. This can vary based on how much the. The self-employment tax rate is %, double the amount W-2 workers have to pay. This is because W-2 workers effectively split the cost of this tax with their. If you're a self-employed contractor in Illinois, you must pay Illinois self-employment tax and income tax if your net earnings or profit are $ or more. Additionally, NC requires income tax to be withheld at the rate of 4% from payments of more than $1, paid during a calendar year to ITIN contractors for. That amount is a total of %, with % of it dedicated to Social Security and % dedicated to Medicare. 2. How much do I owe in self employment tax to. Self-employment tax: This federal tax is how independent contractors pay into Social Security and Medicare and is calculated on Form , Schedule SE. The tax. In theory, you're only paying another ~% in taxes (depending on state and local variances) as a versus a W2 which is the employer's portion of payroll. Small-business owners, contractors, freelancers, gig workers, and others who make more than a $ profit must pay self-employment tax. Self-employed workers. money for retirement without paying taxes on it until it is withdrawn. As Finally, you will need to file a tax return in order to pay your taxes. Essentially independent contractors pay the same taxes as everyone else, but they pay the entire portion of their FICA taxes for themselves (which can then be.

Buy Down The Rate Of A Mortgage

A buydown is a mortgage-financing technique that allows a homebuyer to obtain a lower interest rate for at least the first few years of the loan, or possibly. Mortgages with buydown plans have lower initial payments, a temporarily reduced interest rate and no balloon payments at the end of your loan term. The. You can buy down your interest rate by up to percent to reduce your interest costs and get a lower payment. Before you choose to complete a rate buydown. The actual amount you pay depends on the size of your loan, but you can expect to pay an estimated 1% of the loan amount to buy a %~ reduction of your. The Financed Permanent Buydown Mortgage lowers borrowers' monthly payments without requiring additional cash at closing. With this offering, borrowers can. Mortgage points, also known as discount points, are fees a homebuyer pays directly to the lender (usually a bank) in exchange for a reduced interest rate. Use this 2/1 Buydown Calculator to explore the reduced monthly payments available with the loan program. The initial rate is lower for a set time. Borrowers can choose buydown plans with rates up to 3% lower than current mortgage rates. For example, if market rates. You can lower the interest rate and monthly payments on your mortgage by paying for points up front. Learn more about the benefits of using points here. A buydown is a mortgage-financing technique that allows a homebuyer to obtain a lower interest rate for at least the first few years of the loan, or possibly. Mortgages with buydown plans have lower initial payments, a temporarily reduced interest rate and no balloon payments at the end of your loan term. The. You can buy down your interest rate by up to percent to reduce your interest costs and get a lower payment. Before you choose to complete a rate buydown. The actual amount you pay depends on the size of your loan, but you can expect to pay an estimated 1% of the loan amount to buy a %~ reduction of your. The Financed Permanent Buydown Mortgage lowers borrowers' monthly payments without requiring additional cash at closing. With this offering, borrowers can. Mortgage points, also known as discount points, are fees a homebuyer pays directly to the lender (usually a bank) in exchange for a reduced interest rate. Use this 2/1 Buydown Calculator to explore the reduced monthly payments available with the loan program. The initial rate is lower for a set time. Borrowers can choose buydown plans with rates up to 3% lower than current mortgage rates. For example, if market rates. You can lower the interest rate and monthly payments on your mortgage by paying for points up front. Learn more about the benefits of using points here.

Maximum rate buydown: is 20bps · No Fee Transfer & No Fee Collateral Transfer: Min $, loan (No Fee Collateral Transfer subject to a 10 bp reduction in. A mortgage interest rate buy down is a strategy that lets you snag a lower interest rate than you qualify for in exchange for a lump sum of cash. The buydown allows home buyers to pay a discounted mortgage payment, funded by the seller, for the first two years of their loan! Does a Buydown reduce your interest rate? The buydown subsidy effectively reduces the interest rate on the loan for the first year of the loan by 2% and. Interest Rate Buy Down. A vendor - usually a new-home builder - pays the lender a lump sum to lower the mortgage interest rate by up to 3% over a fixed term. Simply put, mortgage points are fees you can pay to your lender to reduce the interest rate over the life of your loan. This is sometimes called the “mortgage. A mortgage interest rate buy down is a strategy that lets you snag a lower interest rate than you qualify for in exchange for a lump sum of cash. Choosing a Texas lender who offers lower rates over time will require you to pay a fee upfront at closing. Conventional, Texas FHA, Texas VA, and Texas USDA. The Financed Permanent Buydown Mortgage lowers borrowers' monthly payments without requiring additional cash at closing. With this offering, borrowers can. The Buydown Calculation Explanation. To figure out the cost associated with buying down the rate, multiply the loan amount by 1% (or whatever the percent of the. With a permanent mortgage rate buydown, you pay a fee known as discount points to lower your interest rate for the life of your loan. You can purchase as little. A temporary mortgage buydown is a financing option that allows you to obtain a lower interest rate for the first few years of your mortgage. This can help you. Simply put, mortgage points are fees you can pay to your lender to reduce the interest rate over the life of your loan. This is sometimes called the “mortgage. Loan Amount. $ ; Term (Yrs) ; Interest Rate (%). % ; Third-party Contribution toward. Buydown Fee (% of Loan Amount). %. With our rate buydown calculator, you will be able to determine if a temporary rate buydown is the best option for your financial situation. With our new buydown, Embrace will subsidize your rate for the first year of your mortgage — lowering your effective rate 1% for the first 12 months. Yes very much worth it right now. Its a gamble on future rate's though. A lot of ppl believe rates will drop “soon”. I dont. Loan Amount. $ ; Term (Yrs) ; Interest Rate (%). % ; Third-party Contribution toward. Buydown Fee (% of Loan Amount). %. Temporary Rate Buydown · Help Borrowers Lower Their Interest Rate By Up To 3% At The Start Of Their Loan · Give Real Estate Agents More Reasons To Partner With.

Asset Backed Commercial Paper

asset-backed commercial paper (ABCP) from money market mutual funds. (MMMFs) under certain conditions. The program is intended to assist money funds that. In Canada, ABCP is issued by two groups: (i) banks, and. (ii) third parties (non-banks). The restructuring of the. ABCP market in Canada involved paper issued. An asset-backed commercial paper (ABCP) is a short-term monetary-market debt instrument collateralized by a package of loans. A technique for securitizing receivables and similar assets that might have served as collateral for a bank loan or been sold to a factor in an earlier. ABCP is commercial paper (CP) issued by a bankruptcy-remote Special Purpose Vehicle SPV (known as a conduit) and collateralised by pools of underlying. Asset-Backed Commercial Paper (ABCP) is a short-term money market security issued by a special purpose vehicle (SPV) or a conduit formed by a sponsoring finance. Created in the mids, asset-backed commercial paper (ABCP) trailed its term asset-backed securities (ABS) cousin in acceptance by fixed income investors. The proceeds of such issuance are used to finance interests in various assets / securities via a traditional asset purchase or a secured loan. ABCP programmes. A form of commercial paper that is secured by the future cash flows from a wide variety of financial assets. Known as " receivables", such assets may include. asset-backed commercial paper (ABCP) from money market mutual funds. (MMMFs) under certain conditions. The program is intended to assist money funds that. In Canada, ABCP is issued by two groups: (i) banks, and. (ii) third parties (non-banks). The restructuring of the. ABCP market in Canada involved paper issued. An asset-backed commercial paper (ABCP) is a short-term monetary-market debt instrument collateralized by a package of loans. A technique for securitizing receivables and similar assets that might have served as collateral for a bank loan or been sold to a factor in an earlier. ABCP is commercial paper (CP) issued by a bankruptcy-remote Special Purpose Vehicle SPV (known as a conduit) and collateralised by pools of underlying. Asset-Backed Commercial Paper (ABCP) is a short-term money market security issued by a special purpose vehicle (SPV) or a conduit formed by a sponsoring finance. Created in the mids, asset-backed commercial paper (ABCP) trailed its term asset-backed securities (ABS) cousin in acceptance by fixed income investors. The proceeds of such issuance are used to finance interests in various assets / securities via a traditional asset purchase or a secured loan. ABCP programmes. A form of commercial paper that is secured by the future cash flows from a wide variety of financial assets. Known as " receivables", such assets may include.

ABCP is typically issued by a special purpose vehicle (SPV) that is created by a bank or other financial institution. The SPV uses the proceeds from the sale of. What is asset-backed commercial paper program? This is a way of offering low-cost financing to companies that would not otherwise be able to borrow in the. The stigma against ABCP started to change in the new millennium, when event risk of corporate names caused the unsecured commercial paper market to shrink. $35 billion of Non Bank ABCP, on the other hand, was in the form of trusts manufactured by relatively unknown non bank financial corporations. ABCP had. The functioning of the asset-backed commercial paper (ABCP) market was severely disrupted during the recent market turmoil. Asset-backed commercial paper (ABCP) is a short-term investment vehicle whose maturity is less and is between 90 to days. Asset-backed commercial paper (ABCP) is a short-term senior secured debt instrument used by money market funds globally. Unlike financial or corporate. Asset-backed commercial paper program An asset-backed commercial paper program (ABCP program, ABCP Conduit or Conduit) is a non-bank financial institution. Asset-backed Commercial Paper. Asset-backed commercial paper (ABCP) is a type of short-term debt instrument that is backed by a pool of assets. The assets that. The stigma against ABCP started to change in the new millennium, when event risk of corporate names caused the unsecured commercial paper market to shrink. Asset-backed commercial paper is like traditional commercial paper, in that it is issued with maturities of one year or less (typically less than days) and. Graph and download economic data for Asset-Backed Commercial Paper Outstanding (ABCOMP) from to about asset-backed, commercial paper. CBONDS | Asset-backed commercial paper is a short-term financial instrument. It is usually used to diversify portfolios and generate short-term earnings. Asset Backed Commercial Paper (ABCP). Browse Terms By Number or Letter: Short term debt secured by assets. Asset backed commercial paper conduits require a range of ancillary duties including administration of the programme, managing the cash flows of the receivables. SPE: A legally separate entity that purchases the financial assets and issues the ABCP. 4. Liquidity and Credit Enhancement Provider: Parties that can improve. ABCP is commercial paper (CP) issued by a bankruptcy-remote Special Purpose Vehicle SPV (known as a conduit) and collateralised by pools of underlying. Asset-backed Commercial Paper. Asset-backed commercial paper (ABCP) is a type of short-term debt instrument that is backed by a pool of assets. The assets that. An asset-backed commercial paper is a type of collateralized debt obligation that is sold on the secondary market. The company selling the ABCP must set up a. contacts. Overview Team. Cadwalader is a leading law firm in asset-backed commercial paper. We represent issuers.

Trading Options With Margin

The initial(maintenance) margin requirement is 75% of the cost(market value) of a listed, long term equity or equity index put or call option. A margin account is required when trading any long or short options spread/vertical spread. Margin's primary function in options trading is for relief since. Trading on margin is when you borrow money from your broker to place a trade. It's kind of like a loan and if you hold the position overnight then you will. For residents of Canada trading options, the complete margin requirement details are listed in the sections below. Margin is the amount of capital required to open a trade. Brokers and clearing firms use margin to make sure that there is enough money in an account to cover. If you hold enough shares of the underlying stock and then sell to open a call option, the sell short order of options will also apply the margin reduction with. In order to day trade, the account must have at least USD 25, in Net Liquidation Value, where Net Liquidation Value includes cash, stocks, options, and. When an investor writes (sells) put options, they are obligated under the agreed put contract to buy the underlying asset from the put holder if the options are. Trading on margin means borrowing money from a brokerage firm in order to carry out trades. When trading on margin, investors first deposit cash that serves as. The initial(maintenance) margin requirement is 75% of the cost(market value) of a listed, long term equity or equity index put or call option. A margin account is required when trading any long or short options spread/vertical spread. Margin's primary function in options trading is for relief since. Trading on margin is when you borrow money from your broker to place a trade. It's kind of like a loan and if you hold the position overnight then you will. For residents of Canada trading options, the complete margin requirement details are listed in the sections below. Margin is the amount of capital required to open a trade. Brokers and clearing firms use margin to make sure that there is enough money in an account to cover. If you hold enough shares of the underlying stock and then sell to open a call option, the sell short order of options will also apply the margin reduction with. In order to day trade, the account must have at least USD 25, in Net Liquidation Value, where Net Liquidation Value includes cash, stocks, options, and. When an investor writes (sells) put options, they are obligated under the agreed put contract to buy the underlying asset from the put holder if the options are. Trading on margin means borrowing money from a brokerage firm in order to carry out trades. When trading on margin, investors first deposit cash that serves as.

profit from small movements in the price of the security. FINRA's margin rule for day trading applies to day trading in any security, including options. Margin is a practice that allows traders to buy and sell stocks, options, and futures using less capital than the total risk of the trade. Margin = Margin Rate x Index price x (Total Spot Quantity + Total Short Options Quantity) + Total Option Premium received. Example 1: Account has sold Margin trading allows you to increase your buying power by leveraging your account assets. TradeStation offers equities margin interest rates as low as Margin requirements (applies to stock & index options) · % of the option proceeds + (20% of the underlying market value) – (OTM value) · % of the option. Your buying power consists of your money available to trade in your account, plus the amount that can be borrowed against securities held in your margin account. Margin trading can be a complex investment strategy for beginner and even advanced investors investing with options. Prior to buying or selling an option. What are the margin requirements for options? ; Long (Buy) Call or Put. % of the option's premium. ; Covered Write (selling a call covered by long position, or. A margin is an amount that is calculated by ASX Clear as necessary to ensure that you can meet that obligation of your entire Options portfolio on that trading. Options margin is the cash or securities an investor must deposit in his account as collateral before writing (selling) options. Margin in futures trading is different from in stock trading; it's an amount of money that you must put into your brokerage account in order to fulfill any. A margin account lets you leverage securities you already own as collateral for a loan to buy additional securities. Here's an example: Suppose you use. This enables you to exercise an option to buy shares of stock at a discount to its present value. To exercise these options, you must have enough cash to pay. You can think of it as a loan from your brokerage. Margin trading allows you to buy more stock than you'd be able to normally. To trade on margin, you need a. Traditionally investors need to deposit % of the options premium in 2 business days after settlement but it has evolved gradually over the period. Margin in options trading is the collateral you need to write or sell options. This collateral can be in the form of cash or underlying securities for the. When selling call options, a cash account must have at least shares (round-lot) of stock per call option sold. As a result of not having any access to. Portfolio margining is an alternate margin methodology that sets margin requirements for an account based on the greatest projected net loss of all positions in. When trading on margin, an investor borrows a portion of the funds they use to buy stocks to try to take advantage of opportunities in the market. The investor. So let's start with what margin is when it comes to trading. Margin is the amount of money that you hold in your account to enter into a trade. It is used as.

Gigs To Make Money Today

Our extensive database of legitimate, remote, flexible, and hybrid jobs has tons of job postings that make perfect side gigs. Join today and get instant access. If you've got a car at your disposal and you're keen to make the most of it, partnering with platforms like Uber or Lyft could be a smart move. You'll earn cash. If you're hunting for an easy online side hustle, this gig could be your thing. UserTest, Userlytic, uTest, and UserCrowd are popular platforms with competitive. Side Hustle Ideas to Make Extra Money · 1. Rent out a room or your whole house · 2. Get Paid to Grocery Shop · 3. Become a Proofreader · 4. Be a Virtual Assistant. We've rounded up five Atlanta gigs that allow you to make a decent chunk of change in your spare time. You might do bigger things like starting a blog or investing. You might do online tasks or even make real money playing games. Or you can use cash-back apps or. Looking to earn some extra cash? Here are 17 side hustle ideas—both online and in-person—that you can start as early as today, plus tips on finding clients. Handy. People who have a knack for professional cleaning and handiwork can make some extra cash on Handy. Cleaners make up to $22 an hour and handymen make up. Testerwork - a platform where you can make money just by testing websites or applications. · Featurepoints – there you can earn just by. Our extensive database of legitimate, remote, flexible, and hybrid jobs has tons of job postings that make perfect side gigs. Join today and get instant access. If you've got a car at your disposal and you're keen to make the most of it, partnering with platforms like Uber or Lyft could be a smart move. You'll earn cash. If you're hunting for an easy online side hustle, this gig could be your thing. UserTest, Userlytic, uTest, and UserCrowd are popular platforms with competitive. Side Hustle Ideas to Make Extra Money · 1. Rent out a room or your whole house · 2. Get Paid to Grocery Shop · 3. Become a Proofreader · 4. Be a Virtual Assistant. We've rounded up five Atlanta gigs that allow you to make a decent chunk of change in your spare time. You might do bigger things like starting a blog or investing. You might do online tasks or even make real money playing games. Or you can use cash-back apps or. Looking to earn some extra cash? Here are 17 side hustle ideas—both online and in-person—that you can start as early as today, plus tips on finding clients. Handy. People who have a knack for professional cleaning and handiwork can make some extra cash on Handy. Cleaners make up to $22 an hour and handymen make up. Testerwork - a platform where you can make money just by testing websites or applications. · Featurepoints – there you can earn just by.

Fiverr helped give birth to the Gig Economy. Although services start out at $5, some Fiverr sellers are earning six-figure-plus revenues annually. You can sell. One of the best side gigs to make money today is freelance writing. The freelance writing market is highly competitive, but if your writing skills shine and. Start earning today. Get instant access to local jobs. Get paid And thank you gigsmart for making work available to us people who need extra money. Looking to reboot your career and clear some real cash? HelloTech, the Uber of tech support, claims that its independent techies earn an average of $ a day. Work when and where you want to – you can even start making money today. GET Apply for Gigs through the map or Gig List. After being accepted. Self-employment here to stay, thanks to gig communities like Flexjobs, Freelancer, and PeoplePerHour that make it easier than ever to find possible work. We've gathered some of the most popular side jobs in Los Angeles to make extra money. Sign up for Qwick today and sign up to start picking up shifts in Los. Writing Jobs In today's digital landscape, the demand for skilled content writers is more significant than ever. Whether you specialize in blogging. Summary: One of many gig economy food delivery companies, DoorDash lets you earn money as a delivery driver by picking up takeout orders from local restaurants. There are many art-related jobs available online that you can work. Additionally, as a freelancer, you can work on a per-piece basis. This means that whether. Become a Tasker and earn money by completing everyday errands and tasks for people in your area. All it takes is a visit to dashlk.site, where you can select. Tutoring and test prep is a billion dollar a year industry. You can start your own tutoring business to earn extra cash and help students at the same time. Gig Economy Jobs - Participate in the gig economy through services like Uber, Lyft, TaskRabbit, or Postmates. These platforms allow you to earn. According to the American Veterinary Medical Association, almost 39% of households own at least one dog. That means you can make considerable money tapping into. Earn Money Today jobs available on dashlk.site Apply to House Cleaner, Delivery Driver, Snow Plow Operator and more! 1. Survey Sites. Paid online surveys are a great way to make money online. I love them because they are one of the most popular online side jobs. You can rent it out and earn passive income instead of having it sit in your garage. This is the epitome of a night side hustle because you literally make money. Make some extra cash by renting out your truck or extra space in your home. Have an empty garage, driveway, basement, or shed? Why not rent it out? List your. Explore various gig opportunities and practical advice to make extra money and enhance your financial stability. If you don't mind lifting heavy objects and doing a bit of physical work, picking up gigs with a production company can be a great side hustle. Movie sets.